What’s Happening with the U.S. Government Shutdown?

On September 30, the federal budget expires. If Congress does not approve a funding bill, the government will enter a “shutdown.” This means federal agencies stop operating, public employees go home without pay, and key economic data releases — including the monthly jobs report — are halted. It’s not a funding problem but a political deadlock: the House of Representatives is divided, with a Republican faction demanding deeper cuts, while the Democratic-led Senate is promoting a broader spending plan.

Why It Matters to Markets

Political uncertainty generates risk aversion. Investors are moving into safe-haven assets like gold and U.S. Treasuries, while the U.S. dollar loses appeal against defensive currencies such as the yen or the Swiss franc. The suspension of official data also complicates the Federal Reserve’s interest rate decisions, adding volatility to financial assets.

Possible Scenarios

Last-Minute Deal: The dollar and stock markets would rebound, while gold would partially correct from its highs.

Short Shutdown (days): Limited impact, with initial drops in equities and the dollar, but quick recovery afterwards.

Prolonged Shutdown (weeks): Strong pressure on the dollar and stock indices, gold at new highs, and increased tension in the bond market.

Immediate Impact

The market is already showing signs of nervousness. Gold reached a historic high of $3,871.68 before correcting by 1.64%. Wall Street indices are trading cautiously, and the dollar remains weak. The key factor is the duration of the shutdown: the longer it lasts, the greater the damage to confidence and the stronger the reaction in global markets.

Technical Analysis

DXY | H4

Supply Zones (Bid): 97.88

Demand Zones (ask): 97.26

The dollar is gently breaking the 97.67 support, leaving the weekly volume concentration around 97.88 as a supply zone after recent moves. While the price remains below the weekly POC 97.88, further USD selling is expected with a target near last week’s demand zone at 97.26.

This scenario would extend selling in USDJPY, USDCAD, USDCHF, and extend buying in EURUSD, GBPUSD, AUDUSD, NZDUSD, XAUUSD, etc.

A decisive breakout above 97.88 would allow a bullish recovery toward 98.11, 98.55, and potentially 98.78. In that scenario, selling would extend in EURUSD, GBPUSD, AUDUSD, NZDUSD, XAUUSD, and buying in USDJPY, USDCAD, USDCHF.

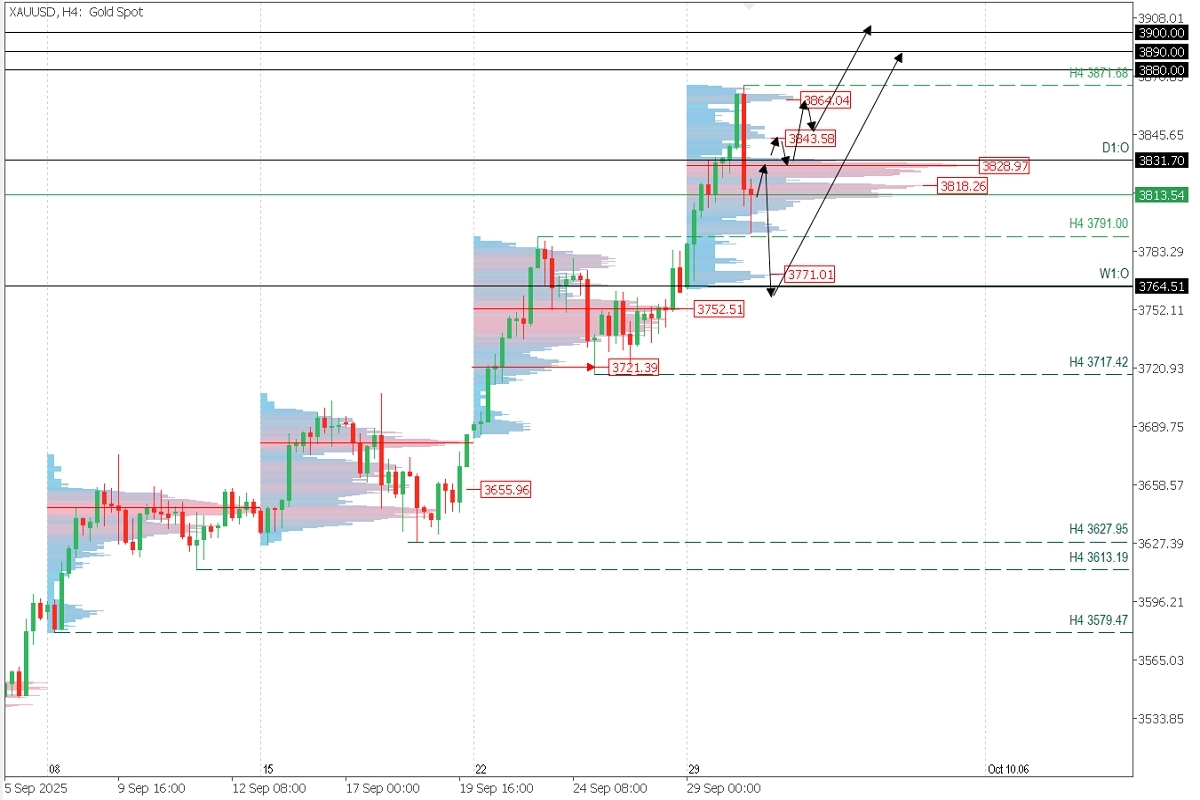

XAUUSD (Gold)| H4

Gold has been strengthening as a safe-haven asset due to multiple factors, and the government shutdown adds extra volatility and risk-aversion, increasing buying interest this week.

The correction of more than 1% today after reaching a historic high of 3,871.68 is likely liquidity-seeking near last week’s weekly high at 3,791, falling below the weekly volume POC at 3,828.97.

While the price remains below the weekly POC 3,828.97, a deeper bearish correction toward 3,764.51 and last week’s buying POC at 3,752.51 is possible, both levels likely to reactivate bulls.

A fast and decisive break above POC 3,828.97 would trigger buying toward 3,845, 3,865, and potentially extend toward 3,880, 3,890, and 3,900 this week.

Key Concepts

Exhaustion/Reversal Pattern (PAR): Always wait for the formation and confirmation of a PAR on M5 before entering trades in key zones. Examples can be found here 👉 https://t.me/spanishfbs/2258

POC (Point of Control): The level or zone with the highest volume concentration. If preceded by a downtrend, it acts as a resistance/selling zone; if preceded by an uptrend, it acts as a support/buying zone.