Fundamental Analysis

Upcoming Earnings: Thursday, October 23, 2025 (Q3 2025, market close)

The market anticipates an EPS loss of around -$0.12 and potentially weaker revenues.

Opportunities

- Government Support & National Chip Strategy: Intel remains the main beneficiary of the U.S. plan to regain technological sovereignty, receiving financial backing, strategic contracts, and priority in semiconductor infrastructure projects.

- Advances in Chips & AI Technology: The new Panther Lake (18A) processors and Crescent Island GPUs represent a significant technical leap. Meeting 2025 mass production timelines could improve its position against TSMC and AMD.

- Restructuring & Financial Discipline: Partial Altera sale and cost-cutting measures indicate Intel is attempting to strengthen profitability and simplify its business model.

- Tech Market Sentiment: The AI boom and strong demand for specialised hardware have revalued the entire sector. Intel indirectly benefits from this wave.

Challenges

- Profitability Still Weak: Intel Foundry remains unprofitable and relies on massive investments to take off.

- Intense Competition: TSMC, Nvidia, and AMD continue to lead high-performance chips. Intel has yet to demonstrate a clear advantage in efficiency or execution speed.

- High Valuation: After rising nearly 80% in 2025, some analysts warn the stock may have run ahead of its actual results.

- Execution is Critical: If upcoming earnings don’t show tangible improvements in margins or production, the market could punish the stock in the short term.

Conclusion

Intel is experiencing a recovery with partially solid fundamentals, driven by government support and the promise of its next-gen chips.

However, financial performance still lags market enthusiasm. Over the next three months, performance will hinge on the October 23 earnings:

- If profitability and production improvements are confirmed, the stock may remain a mid-term opportunity.

- If disappointing, the current price may reveal a temporary overvaluation. Technical Analysis

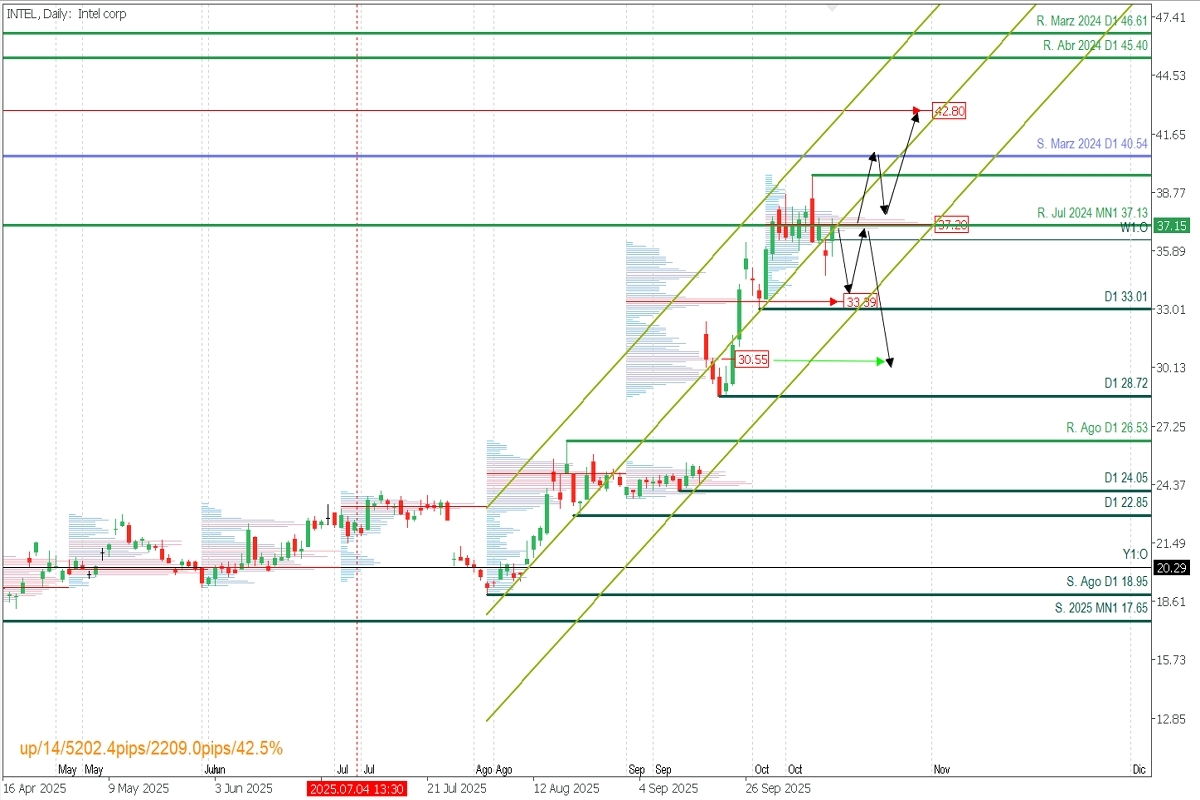

INTEL – Daily Chart

- Supply Zones (Sell): 37.20 | 42.80

- Demand Zones (Buy): 33.39 | 30.55

Intel remains in a daily uptrend, trading within an ascending linear regression channel. The latest key daily support is at 33.01, close to the demand zone and the September uncovered POC at 33.39.

The price is trading around the monthly volume concentration (POC) at 37.20. A breakout in an optimistic environment could expand the bullish bias toward the March 2024 support, now acting as resistance at 40.50, followed by the March 2024 supply zone at 42.80 as the next targets.

However, market optimism has faded, and there’s a risk that the price may fail to break the monthly volume barrier around 37.20, increasing bearish pressure toward key daily support at 33.01 and possibly the September buying volume zone around 30.55.