What is the Cypher pattern?

The Cypher pattern is a reversal formation within the harmonic class of patterns. It occurs across various financial markets including Forex, futures, stocks, and crypto. The cypher pattern consists of four separate price segments, with defined Fibonacci relationships. The Cypher is one of the most accurate and advanced harmonic patterns, introduced by Darren Oglesbee.

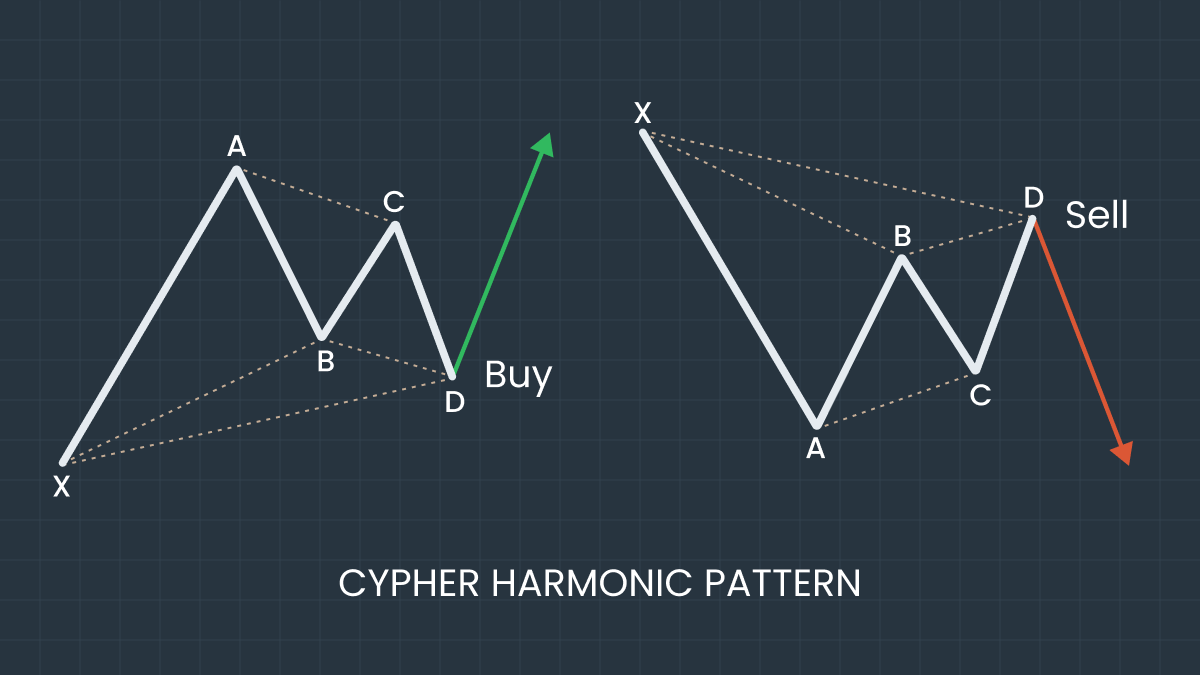

In an uptrend, the Cypher pattern makes higher highs and higher lows. Vice versa, in a downtrend, the Cypher pattern makes lower lows and lower highs.

Another attractive characteristic of the Cypher pattern is that the first three legs within the formation resemble a zigzag or lightning bolt.

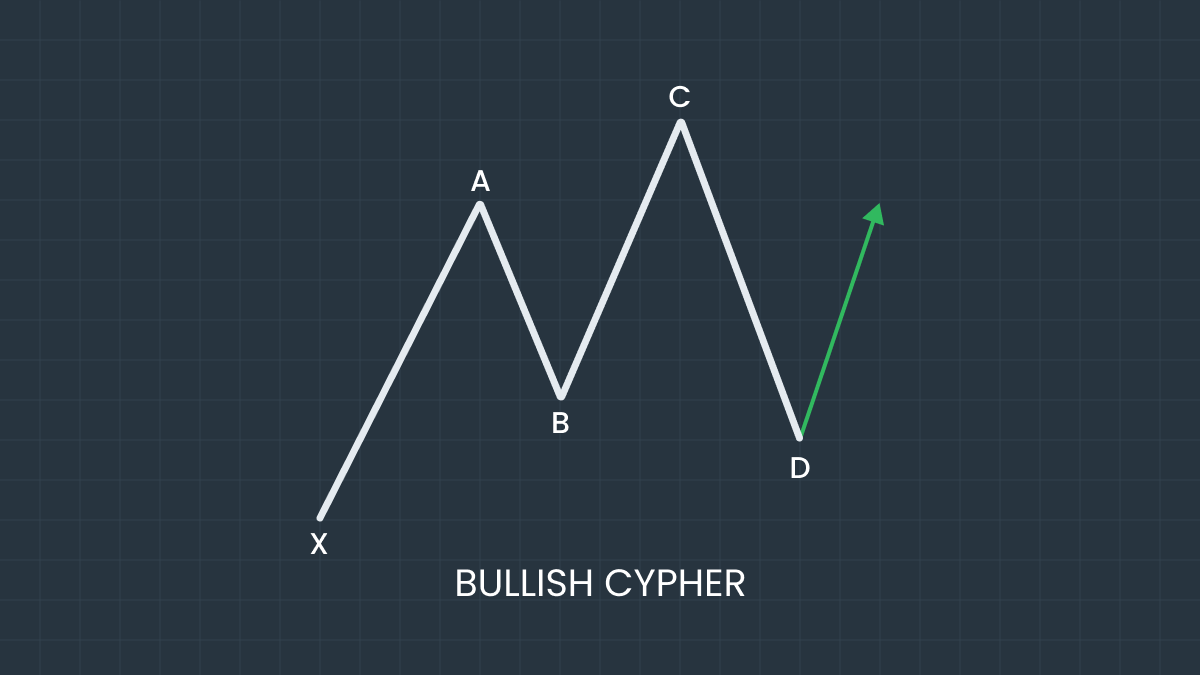

Below you can see an example of a bullish Cypher pattern.

You can notice that the pattern is a five-point XABCD structure, which consists of four individual segments. In bullish formation, the A point and the C point make higher highs, and the B point makes a higher low.

Rules of the Cypher pattern

There are some rules for classifying a valid Cypher pattern. The XA segment should always be impulsive. The AB segment, a corrective movement, retraces a portion of the XA segment. The BC segment continues the movement of the first (XA) segment and forms a higher high. Finally, the CD segment retraces a large portion of the entire movement between points X and C.

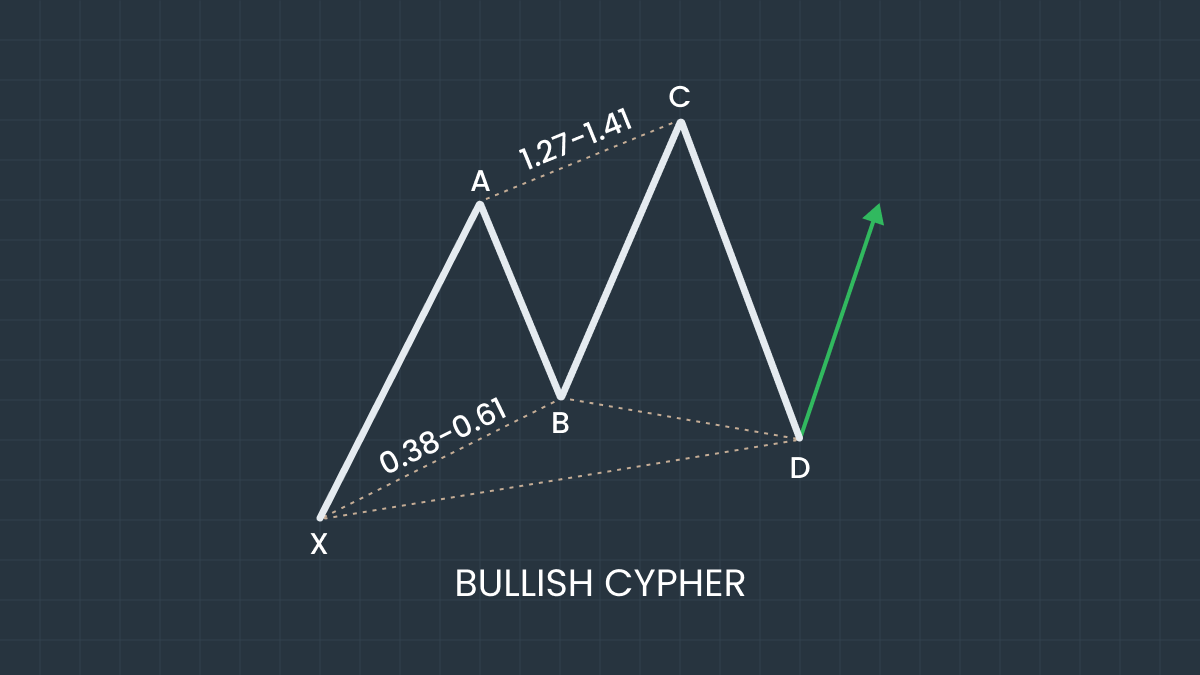

Traders use two primary Fibonacci tools to define the Cypher pattern. The first is the Fibonacci retracement, and the second is the Fibonacci projection.

The AB segment must retrace the XA segment by at least 38.2%, and it should not exceed 61.8%.

The C point within the structure should be a minimum 127% projection of the XA segment, measured from point B. At the same time, the C point should not extend beyond the 141.4% level.

Point D should terminate at or near the 78.6% Fibonacci retracement level of the price move as measured from the start at point X to point C.

As soon as the price reaches the 78.6% retracement level at point D, the bullish Cypher pattern is considered valid, and a further price increase is expected.

The first and last are the most important rules for the Cypher pattern.

If the shadow of the candlestick appears inordinately large, then it will be better to use the candle close for measuring. If the shadow is of standard size, it’s more reliable to use it instead.

Cypher trading strategy

When you find the trading pattern with the proper Fibonacci relationships, you can prepare for a potential trade near the Cypher’s completion point.

To open a long position upon detecting a bullish Cypher trading pattern, follow this trading strategy:

Enter a limit order to buy at the 78.6% retracement level of the XC segment, also known as the D point.

Place a stop-loss order below point X.

It’s better to use a two-tiered take-profit target strategy. A trader should set the first target below the A point and the second target below the C point.

To open a short position within the bearish Cypher trading pattern, follow these steps:

Enter a limit order to sell at the 78.6% retracement level of the XC segment. This is known as the D point.

Place a stop-loss order above the X point.

A trader should set the first target just above the A point and the second just above the C point swing low.

How to draw a Cypher pattern

You need to follow several steps to draw a Cypher pattern.

First, download and install the custom harmonic pattern indicator. In the MT4 and MT5 terminals, you can locate the harmonic pattern indicator in the indicator library.

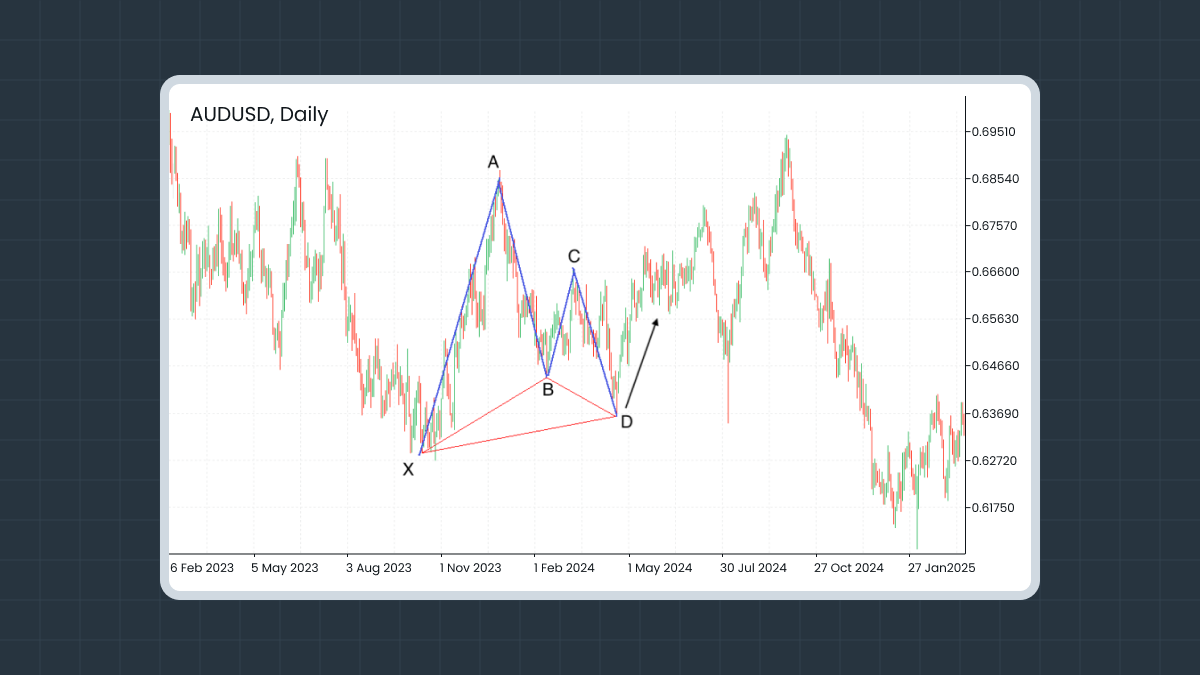

Identify the starting point X on the chart, which can be any swing high or low point.

Once you’ve located your first swing high/low point, follow the market swing wave movements.

You need to have four points or four high/low swings that bind together and form Forex harmonic patterns. Every swing leg must be validated and abide by the Cypher pattern Forex Fibonacci ratios described above.

Summary

The Cypher pattern is one of the most advanced harmonic structures. However, this pattern has a high probability of success and offers a solid risk/reward ratio.

Like many other patterns, the Cypher pattern works better on higher timeframes like four hours and above.