Types of Trading: Brief Summary

| Type of Trading | What It Means | Timeframe | Core Strategies | Best For |

| Day Trading | Buying and selling assets within one day, without holding overnight | Minutes to hours (intraday) | Technical tools, fast charts, short-term signals | Active traders with time and market focus |

| Position Trading | Long-term strategy based on major market trends | Months to years | Buy-and-hold, macro trends, fundamental signals | Patient traders with a hands-off mindset |

| Scalping Trading | Making dozens of tiny trades to profit from small price changes | Seconds to minutes | Rapid entries, order flow, tight spreads | Fast-paced, detail-driven traders |

| Swing Trading | Catching price moves that play out over days or weeks | Short to medium-term | Trend following, support/resistance, chart analysis | Part-time traders or those with flexible hours |

| Momentum Trading | Riding strong trends until they show signs of slowing | Short to medium-term | Breakouts, volume spikes, trend strength | Traders who act quickly and love volatility |

| Algorithmic Trading | Using automated programs to place trades based on set conditions | Any (depends on setup) | Bots, coded strategies, high-speed systems | Tech-savvy or institutional traders |

| Fundamental Trading | Using economic news and financial data to assess asset value | Medium to long-term | Earnings reports, interest rates, global trends | Traders who follow macro events and data |

| Technical Trading | Analyzing price charts and patterns to predict future movements | Any | Indicators, trend lines, historical price data | Visual thinkers who trust market signals |

Timeframe-based trading strategies

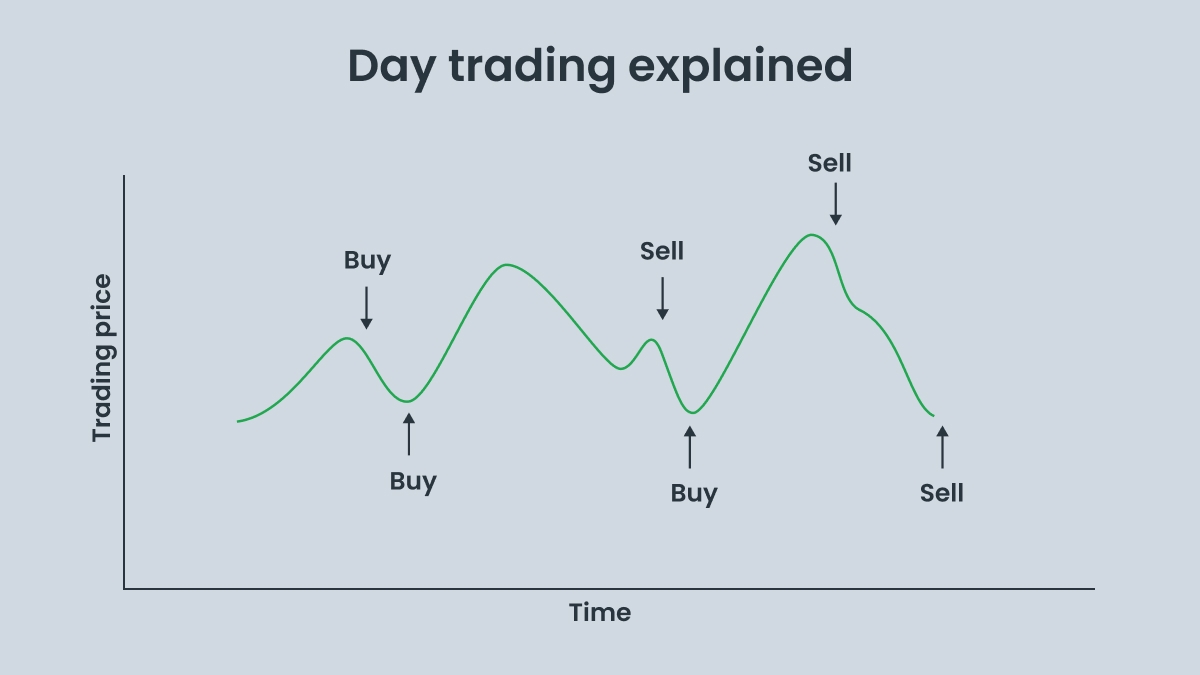

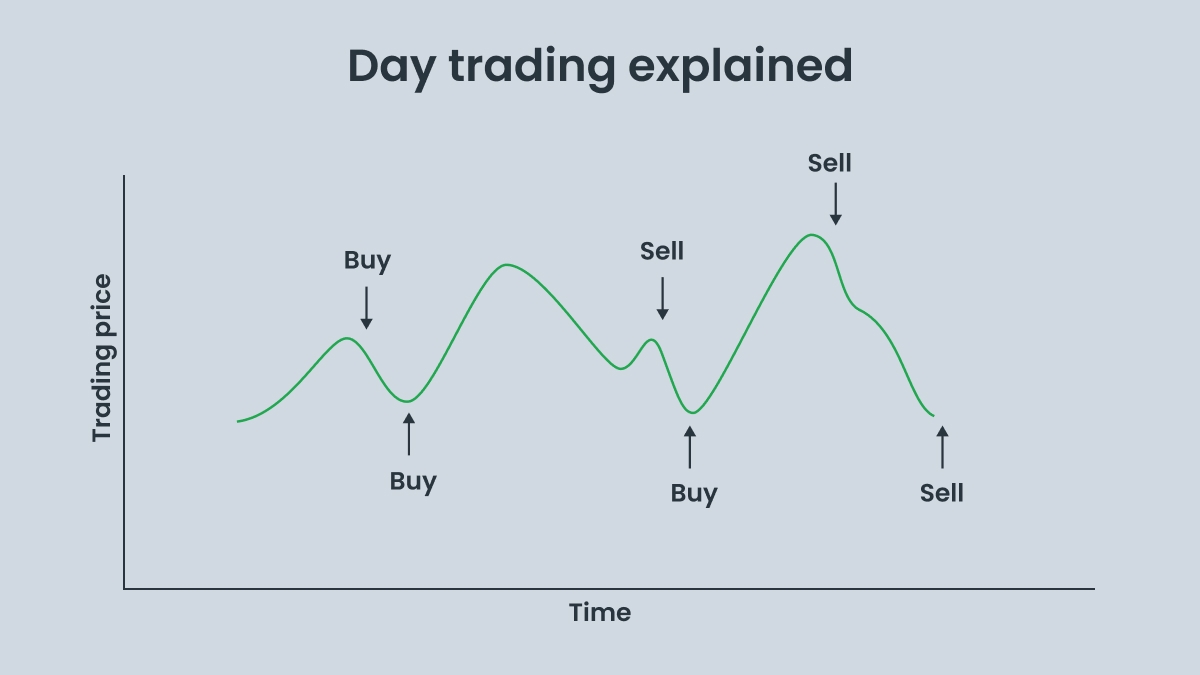

Day trading

Day trading is one of the fastest-paced types of trading. Traders open and close positions within the same day, or sometimes in a matter of hours or minutes. They generally don’t hold overnight positions to limit their exposure to unexpected shifts. This approach requires speed, precision, and quick analysis of technical data and market news.

Position trading

When you think of long-term trading approaches to the markets, this one is often the first that comes to mind. Position trading considers moves that unfold over weeks, months or longer. It focuses mostly on trends in the global economy and crucial financial indicators. This approach appeals to traders who choose to be less active and have more time to analyze the broader picture. Lots of them follow fundamental data to determine when to enter or exit a position.

Scalping

Scalping is an ultra-short-term strategy where traders try to monitor and catch tiny price changes across dozens of trades a day. It’s intense, demanding, and fits those with the tools and mindset to move fast. A scalper acts quickly, often exiting positions within seconds or minutes to turn small wins into larger profits. This type of trading requires more focus and execution than the others.

Swing trading

Unlike day trading or scalping, swing trading offers traders a bit more room to maneuver. It focuses on short- to mid-term price movements that play out across a few days or weeks. This method is a fusion of technical tools and market news so you don’t need to watch the screen all day. For many, it is the most flexible of all types of trading strategies.

Strategy-based trading types

Momentum trading

For traders who value speed, momentum trading is the perfect style. It follows strong price trends and aims to catch quick profits while the momentum lasts. This approach depends mostly on timing, spikes in volume, and price strength to catch assets on the move. It’s great for volatile markets, where direction can turn quickly bringing swift rewards.

Algorithmic trading

Algorithmic trading replaces human decision making with automated rules. Using scripts, traders can set the best conditions for going into and out of trades based on time, price and volume. This helps to remove emotions and provides exact, high-speed execution. Institutions and experienced traders who believe in data more than instinct usually choose this method.

Fundamental trading

For those who focus on a global picture rather than daily charts, fundamental trading is a common choice. It looks at what drives real value — earnings reports, inflation rates, and central bank decisions. Traders use this information to compare market prices and find out if assets are over- or underpriced. Of the different types of trading, this method is the closest to real-world events and global economic trends.

Technical trading

Charts have their own story to tell, and technical trading is all about reading that story well. This trading approach pays attention to patterns, indicators and price levels to define the next market move. Instead of focusing on news or financial data, it analyzes price changes. This method is popular among short-term traders who prefer visual clarity and choose to make quick decisions.

Choosing the right trading types

Consider these key factors when finding a style that works best for you:

Time. In some methods, you need to monitor data throughout the day, while others offer a more passive approach. If you can spend a few hours every day, you might prefer more fast-paced styles such as day trading or scalping. If your time is limited, swing position trading might be a better fit.

Risk. Each strategy bears its own risk level. Unlike short-term strategies, long-term approaches may seem safer. However, they aren’t immune to market changes. Before choosing your method, decide on how much you can afford to lose without emotional stress.

Tools. Manual trading requires you to stay focused and make quick decisions. Algorithmic or automated methods focus more on technology and early preparations. Your comfort with analysis tools and software will help define which setup suits you better.

Traders also consider whether they prefer timeframe-based styles or strategy-based methods. Some mix the two, but a clearer understanding reduces confusion and enables smarter decisions.

Why does risk management matter in different types of trading?