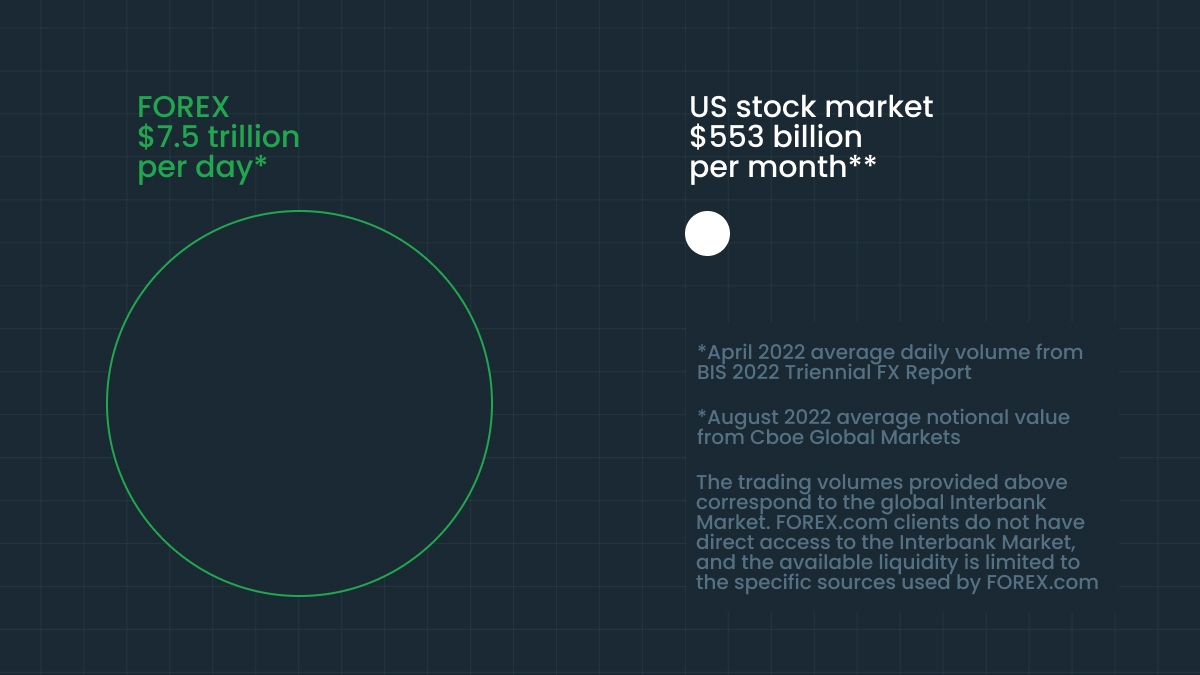

Forex trading continues to attract millions of traders around the world. Every day, around $7.5 trillion moves through the Forex market, and for good reason! As the largest financial market, it plays a central role in global commerce.

In this article, you’ll get a clear view of the key benefits of trading Forex, what makes this market unique, how it compares to others, and why so many traders choose it every day.

Core benefits of Forex trading

Forex is where people and companies exchange money from different countries. For example, when someone sends money abroad, when a business pays for products from another country or when people invest internationally, it all happens through the Forex (foreign exchange) market.

This market has become a favorite for traders of all sizes. People like it because:

Getting started is easy. You can begin with any amount of money.

Most brokers don’t charge extra fees, so it’s a low-cost market. They earn from the small difference between the buy and sell price (spread). It depends on the broker and account type, but FBS doesn’t charge any commissions.

It works no matter your budget. Whether you have $100 or $1 million, the strategy can stay the same.

Trading is simple to follow. You always trade in currency pairs, like buying euros and selling dollars. You can earn money when prices go up or down.