Double and Triple Threes are the trickiest wave patterns, which consist of zigzags, flats, triangles, double and triple zigzags. There’s no any rule related to order of these correction patterns, except a position of a triangle in these structures.

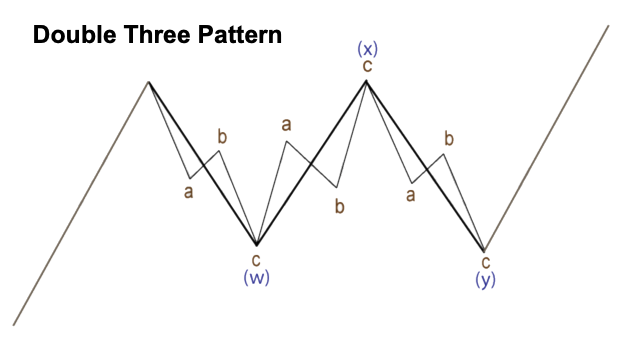

What’s a Double Three pattern?

Simply put, that’s a combination of three correction patterns. Let’s have a look at an example below:

The main rules for Double Threes trading

- Double Three consists of three waves, which are marked as W-X-Y

- Wave W could be any correction pattern, except triangles

- Waves X and Y could take the form of any correction pattern

- Double Three is formed horizontally or with a low dip against the main trend

- In most cases, Double Threes are not deep corrections.

We could count a correction as a Double Three only when the structure is almost over. In other words, it’s not possible to predict this pattern from the very beginning of a correction. So, if a structure, which fits the Double Three’s rules arrives, only then we could decide to mark this pattern.

It’s important to understand that when we have just finished wave X, there’re always a few ways to finish the correction. We could have an impulse so that the correction could take the form of a flat. If a long zigzag is formed instead, then the correction turns out to be a double zigzag. Finally, if we have just a small zigzag, as shown in the chart above, then we could consider the possibility to have a double three pattern.

Real Examples

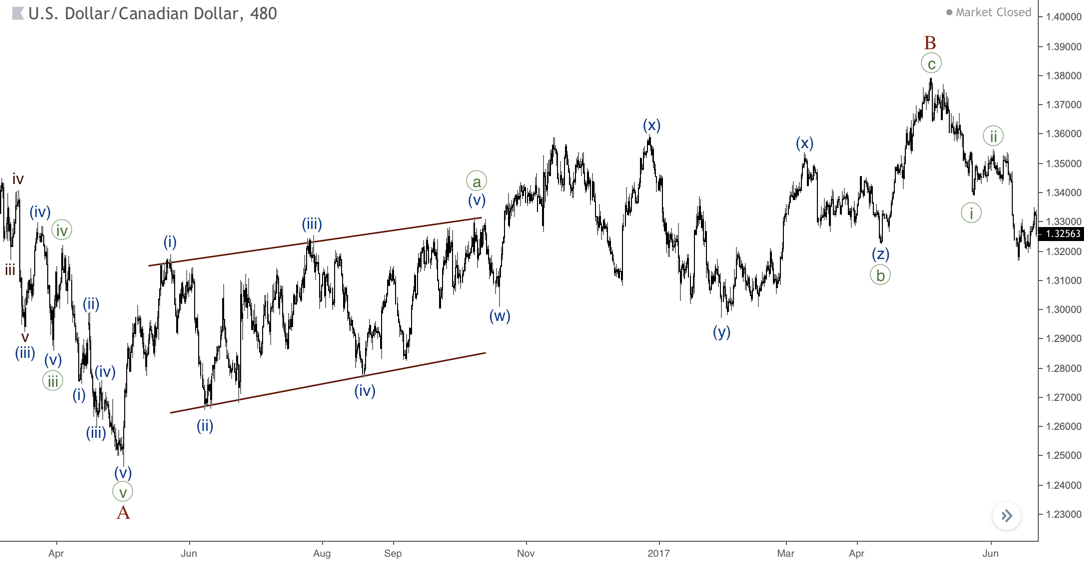

A Double Three pattern from zigzags is shown on the chart below. As you can see, waves (w), (x) and (y) are zigzags, so it’s the easiest shape of this pattern. Note that wave (y) is much the same as wave (w), so the correction moves almost horizontally, which is the key point in the rules for Double Threes.

Another example is on the next chart. There’s a Double Three pattern with huge wave (x). Also, we could perfectly see the difference between a Double Three and a Double Zigzag. Wave (x) here is a Double Zigzag, so this wave has an upward direction. Wave ((iv)) has no direction, so we could mark it like a Double Three pattern as (w)-(x)-(y).

Let’s have a look at the chart below. There are two Double Threes in waves B and ((x)). Wave (y) of ((x)) is a flat pattern, which the trickiest part of the structure. Meanwhile, both Double Threes patterns have a horizontal direction (remember, that’s the guiding criterion of any Double Three).

Sometimes wave X could be far longer than the wave W. As you can see on the next chart, wave (x) ended below the starting point of the wave (w), but then an upward zigzag in wave (y) has arrived. Moreover, wave (a) of (x) is a leading diagonal that makes this count even more complicated. So, in the real-time wave counting, we could make a decision on a possible ending of the wave ((b)) as a Double Zigzag only after waves (i) and (ii) of ((c)).

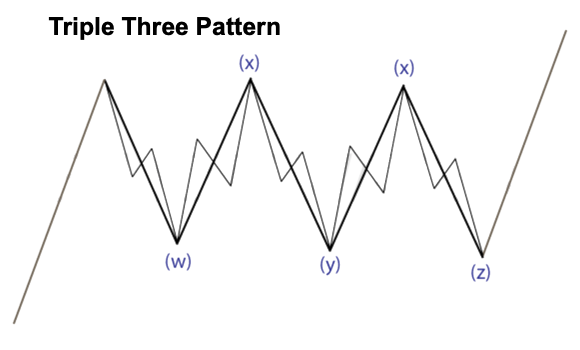

What’s a Triple Three pattern?

This pattern is longer than Double Three, so it subdivides into five waves, which all move sideways against the main trend.

The main rules for Double Threes trading

- Triple Three consists of five waves, which label as W-X-Y-X-Z

- Waves W, X, and Y could be any correction pattern, except triangles

- Second wave X and Z could take the form of any correction pattern

- Triple Three is formed horizontally or with a low dip against the main trend

- In most cases, Triple Threes are not deep corrections.

Triple Three is quite a rare pattern, so you should try to avoid counting it in real time. You can see an example of this pattern on the next chart, where wave ((b)) is a Triple Three. We could consider this structure as a Triple Zigzag only after wave (z). Actually, it works for all other correction patterns, so we should always wait until the full structure of correction arrives to make a decision on one or another wave count, which fits the rules the most.