Construction of the Alligator Indicator

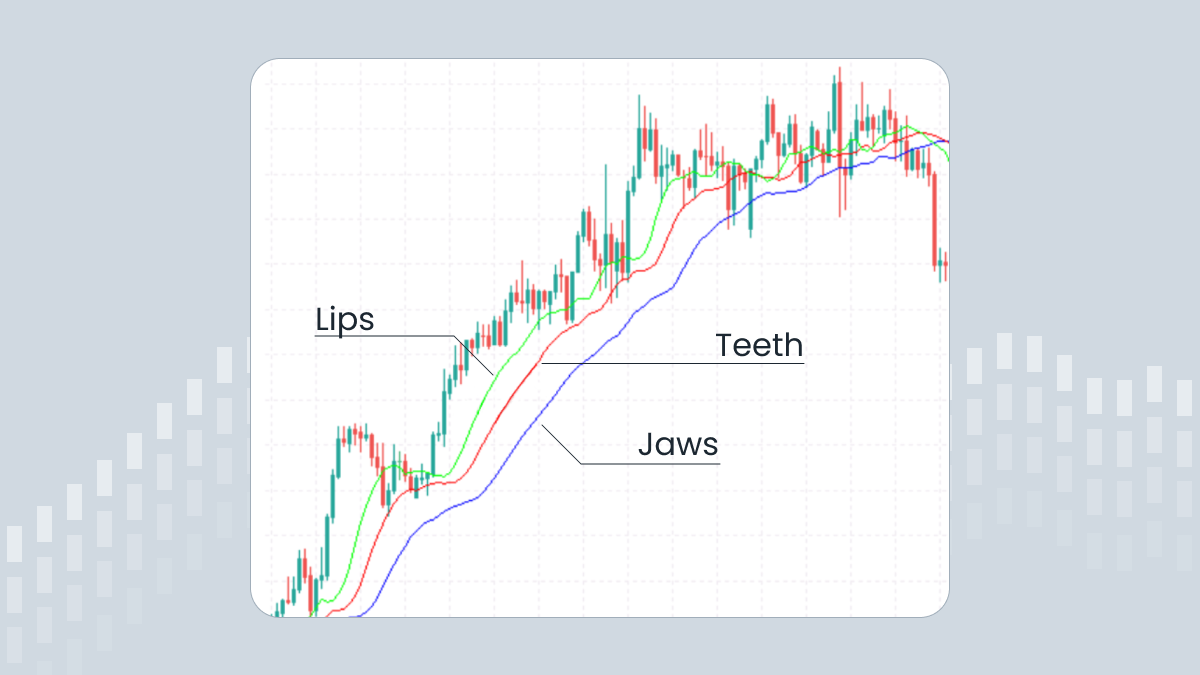

The indicator consists of 3 moving averages which are offset toward the future:

The alligator’s jaw (the blue line) – a 13-period smoothed moving average that is moved 8 bars into the future.

The alligator’s teeth (the red line) – an 8-period smoothed moving average that is moved 5 bars into the future.

The alligator’s lips (the green line) – a 5-period smoothed moving average that is moved 3 bars into the future.

Bill Williams refers to these moving averages as “balance lines”. You can see that he also gave creative names to the indicator and its elements. His idea was to provide an example that would demonstrate the behavior of the market. In this case, the example is the alligator, which alternates between periods of sleep and hunting.

How to interpret the Alligator indicator

When the Jaw, the Teeth, and the Lips are intertwined, that means the alligator is asleep and there’s no uptrend or downtrend on the market. Bill Williams recommends staying out of the market during such periods. The longer the alligator sleeps, the hungrier it wakes. When it wakes up from a long sleep, it opens its mouth (moving averages diverge) and gets ready to take a big bite of the market. It’s time to trade! The alligator will chase the price far and offer a decent profit to a trader. Having eaten enough, the alligator goes back to sleep (moving averages converge), and that’s when it’s time to reap your profits.

If the alligator is not asleep, the market is either in an uptrend or a downtrend.

If the price is above the alligator's mouth, then it's an uptrend. The indicator lines take a bullish order (green on top, then red, then blue).

If the price is below the alligator's mouth, then it's a downtrend. The alligator’s lines take a bearish order (blue on the top, then red, then green).

The balance lines can provide resistance/support during the trend phase. The price can go beyond the green line for short periods of time. The more it tries to break the green line, the weaker the trend becomes.

It’s also possible to look for “fake crosses” — situations when the green line crosses the red line, but then turns back. If such a cross happens during an uptrend, you can buy once the green line returns to above the red one.

Combining the Alligator with other tools

There may be many different combinations between the Alligator and other technical analysis tools. Here are some suggestions.

Look for a reversal pattern (chart pattern or candlestick pattern). Once you have it, use the Alligator for confirmation (i.e. wait for the green line to cross other lines).

Use the Alligator together with Fractals. Wait for a moment when the Alligator is sleeping (balance lines are intertwined). Put a buy-stop order 1 pip above the latest fractal up on the chart, which is located above the alligator’s mouth.

Summary

The Alligator indicator has a unique formula that distinguishes it from a simple set of moving averages. Based on moving averages, the indicator does react to the price changes with a time lag. At the same time, it can be used for both picking out the start of a new trend, and choosing a moment when a trend resumes after a correction. The Alligator is a ready-to-use trading system that can be accompanied by other analytical tools for greater precision in trading. When you use the Alligator, make sure to check several timeframes of the chart.